I’ve been trading stocks and writing about the market for over 25 years. And I have never seen an extreme disconnect between market values and reality.

There are 36 million unemployed. GDP will fall 30% and earnings will drop by 20%.

There is a renewed trade war with China and a simmering Cold War. The Fed has digitally printed $7 trillion. The difference between work from home people and those without work has pushed inequality to unprecedented heights.

We are divided and lost. Add to this race riots and the threat of martial law and… the stock market goes up.

The Dow is over 25,600…

The NASDAQ is at 9,633…

The S&P 500 is at 3,068…

Gold hit $1,750 an ounce…

Silver breached $18.76 an ounce…

WTI Crude is trading at $35.54 a barrel.

There are many ways to value a stock market, and by all of them it is overvalued.

Here is the Buffett indicator:

It represents the total market capitalization to gross domestic product.

You find a market capitalization or market cap, by multiplying the share price by the total shares outstanding.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

So, when the value of all the shares from the Wilshire 5000 added up is less than the GDP of the United States –– you buy. If they are 60% more than GDP you sell.

As you can tell by the chart, we are extremely overvalued.

CBO’s Lost Decade

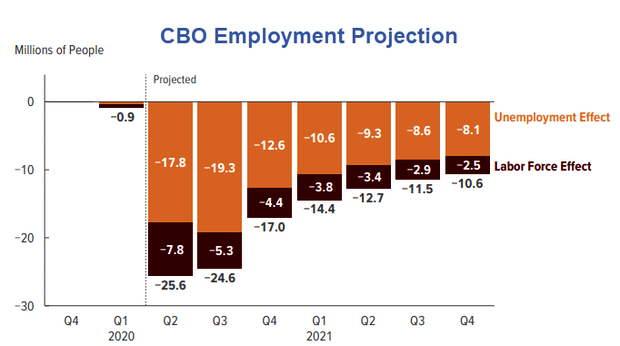

It is so bad that the Congressional Budget Office projects that it will take 10 years to pull out of it.

The CBO predicts that unemployment will be bad for years:

And yet the “Everything Bubble” continues as the Fed pumps money into the market. Many people are sitting at home with $1,200 and money saved from gasoline and other bills. With everything shut down except the stock market they are chasing stocks.

Robinhood, a broker that has free trades and allows you to buy fractions of shares, is booming. Investors from this platform are pushing up speculative stocks from Penn National Gaming (NASDAQ: PENN) to Carnival Cruise(NYSE: CCL) and Macy’s (NYSE: M).

There are stock promoters out there paying Twitter users to pump bankrupt stocks like Hertz (NYSE: HTZ). This has always been a thing but it seems more brazen and pronounced these days.

And to top it off these new day traders are arrogant because they are winning. The checks hit two months ago after the market had crashed. Then they bought into the greatest two month period we’ve seen in decades.

God bless them.

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.